Benefites of SBI Credit Card Total Benefits...

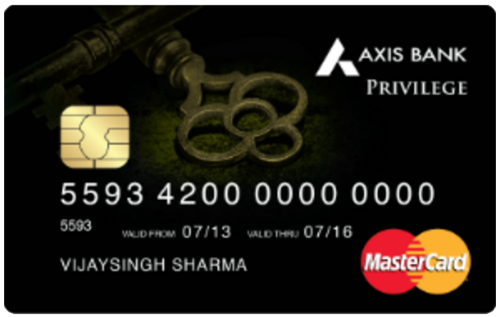

The Axis Bank Privilege Credit Card aims at providing some exclusive Travel and shopping experiences to the customers. The card is lifetime free for priority banking customers and for others, this credit card charges a joining fee of Rs. 1,500. You can earn up to 12,500 EDGE Reward Points in the form of welcome benefits that can be redeemed against multi-brand vouchers worth up to Rs. 5,000. With this card, you get 10 EDGE Points on every Rs. 200 you spend. Moreover, you also get exclusive travel & dining benefits, including complimentary airport lounge access and exclusive discount offers on dining. You also get an opportunity to earn 3000 bonus EDGE Points every year on card renewal. If your total annual spend reaches Rs. 2.5 lakhs, your renewal fee for the next year is waived off, and you can double your benefit by redeeming your Reward Points against the shopping and travel vouchers worth twice the value of your earned EDGE Points. The list of this card’s benefits doesn’t end here. To know detailed information about the advantages of the Axis Bank Privilege Credit Card, refer to the information given below:

New Features

Waiver of renewal fee on the spending of Rs. 2.5 Lakhs in the anniversary year.

3.4% per month

Nil

Nil

1% waiver at all fuel stations on transactions between Rs. 400 and Rs. 4,000

3.5% on all international transactions

Rs. 500 or 2.5% of the amount withdrawn, higher of the two.

While dining at 4,000+ partnered restaurants, you can enjoy up to 20% discount.

Complimentary access to the domestic lounge every year.

NA

On every Rs. 200 spent using this credit card, you will get 10 EDGE Points.

NA

You get insurance coverage for air accidents, lost/delayed baggage, lost travel documents, and purchase protection.

You can redeem the EDGE Points, for 1 EDGE Point = Rs. 0.20 against a variety of products and vouchers.

2 complimentary visits to the domestic lounges every quarter.

No liability in case of fraudulent transactions if loss or theft of the card is reported to the bank.

No data available

No data available