Benefites of SBI Credit Card Total Benefits...

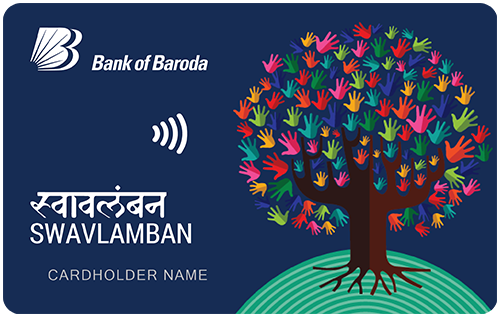

The Bank of Baroda Swavlamban Credit Card is an entry-level card offered by the bank. It comes with an annual fee of Rs. 250, which you can easily get waived off by using your credit card regularly and achieving the required annual spend. A very special thing about this credit card is that cardholders can use up to 105% of their credit limit without any over-limit charges. Generally, all credit cards charge an over-limit fee even if you spend a single penny above your credit limit, but this is not the case with this card. Talking about its reward rate and other benefits, it offers a decent reward rate of 1% across all the categories and the cardholders can redeem their earned rewards against their card’s outstanding balance. Other features of the card include insurance against accidental death, fuel surcharge waiver, zero liability protection, etc. For detailed information about the BoB Swavlamban Credit Card, its features, and fees & charges, keep reading:

New Features

The joining fee (if applicable) would be waived off on spending Rs. 2,500 within 60 days, and the annual fee (if applicable) would be waived off on spending Rs. 12,000 in the previous year.

3.49% per month

Nil

Nil

1% fuel surcharge waiver on all fuel transactions between Rs. 400 and Rs. 5,000. The maximum waiver is capped at Rs. 250.

3.5% of the transaction amount

2.5% of the withdrawal amount subject to a minimum of Rs. 500.

NA

NA

NA

1 Reward Point on every retail spend of Rs. 100.

NA

The cardholders get an insurance coverage against personal accidental death.

The Reward Points earned using this credit card can be redeemed against cashback at a rate of 1 Reward Point = Re. 0.25.

NA

The cardholders won’t be liable for fraudulent transactions against a lost/stolen card if the loss is reported to the bank in a timely manner.

No data available

No data available