Benefites of SBI Credit Card Total Benefits...

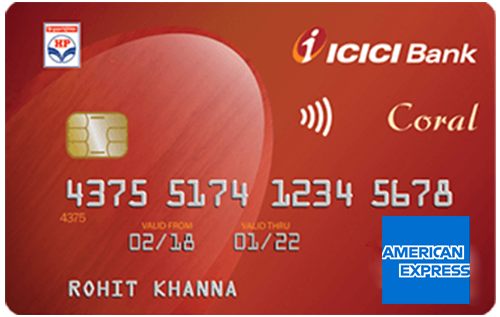

ICICI HPCL Coral American Express Credit Card is a co-branded card launched by ICICI Bank in partnership with Hindustan Petroleum Corporation Limited (HPCL) and American Express. As an entry-level card, it carries a renewal fee of Rs. 199. The card earns you 2 Reward Points for every Rs. 100 you spend with the card and accelerated 3X Reward Points (6 Points) on every Rs. 100 you spend on fuel at HPCL filling stations. Although, other benefits like complimentary lounge access and insurance covers are missing, it can be a good choice in the entry-level segment if you travel by road a lot. Keep reading to learn more about this entry-level co-branded offering by ICICI Bank.

New Features

The renewal fee can be waived if you spend Rs. 50,000 in the previous year.

3.40% per month (or 40.8% per annum)

Nil

Rs. 99 (plus applicable taxes) per redemption request

1% fuel surcharge waived at all HPCL petrol pumps in India for fuel purchases below Rs. 4000.

3.5% of the transaction amount

2.50% or a minimum of Rs. 300

25% discount (max Rs. 100) on purchasing a minimum of two tickets for movie in a single transaction (max 2 times in a month), exclusive dining benefits under the ICICI Bank Culinary Treats Program.

N/A

N/A

2 Reward Points per Rs. 100 on all retail spends with the card, 3X (6) Reward Points on fuel transactions at HPCL filling stations, 2.5% cashback up to Rs.100 on fuel purchases at HPCL pumps.

N/A

N/A

The Reward Points earned are redeemable against cash back or gifts (1 Reward Point = Re. 0.25).

N/A

N/A

No data available

No data available