Benefites of SBI Credit Card Total Benefits...

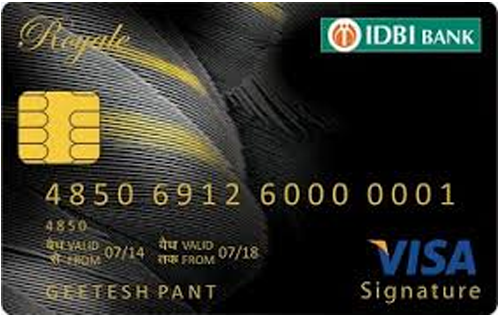

The Royale Signature credit card by IDBI bank is an entry-level shopping credit card. You don’t have to pay any annual membership fee for this card. Although it is a very basic card, you do get a few travel benefits like complimentary domestic lounge access and a personal air accident cover worth Rs. 25 lakh. Read on to learn more about this entry-level offering by the IDBI bank.

New Features

Rs. 99 + GST

2.5% of the transaction amount, subject to a minimum charge of Rs. 500.

3.5% of the transaction amount

Nil

1% fuel surcharge waived off at all fuel stations across India for transactions between Rs. 500 and Rs. 4,000 (max waiver capped at Rs. 500)

N/A

1 Complimentary domestic airport lounge access every quarter under the Visa domestic lounge program.

N/A

Rs. 99 + GST

No data available

No data available