Benefites of SBI Credit Card Total Benefits...

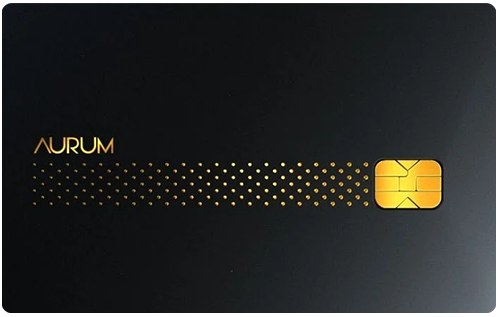

SBI Card has ventured into the super-premium credit card segment with the introduction of the metallic Aurum Credit Card. The Aurum Credit Card competes directly with HDFC Bank Infinia, ICICI Bank Emeralde, and American Express Platinum credit cards. Previously, the ELITE Credit Card held the position as SBI Card’s most premium offering, but it has now been replaced by the Aurum Card. The SBI Aurum Credit Card boasts a premium appearance, featuring a metallic design and an elegant black finish adorned with golden stripes. In addition to the standard Reward Points benefits, this premium credit card offers a range of complimentary privileges. You would receive complimentary gift vouchers from Tata CliQ Luxury and Taj upon achieving specified spending milestones. Keep reading to discover more about this super-premium offering from SBI Cards.

New Features

Annual membership fee waived off on annual spends of Rs. 12,00,000

3.5% per month (42% per annum)

Nil

N/A

1% fuel surcharge waived off at all fuel stations across India.

1.99% of the transaction amount

2.50% of the withdrawn amount, subject to a minimum charge of Rs. 500

Complimentary memberships of Zomato Pro and Eazydiner Prime and 4 movie tickets from BookMyShow every month (max cap of Rs. 250 per ticket)

Complimentary domestic and international airport lounge access and complimentary airport spa access.

Unlimited international airport lounge access with complimentary Dreamfolks lounge program membership

4 Reward Points per Rs. 100 spent (reward rate of 1%)

N/A

N/A

Reward Points are redeemable for gift vouchers, hotel reservations, flight tickets etc., on dedicated AURUM Rewards portal

4 complimentary domestic lounge access under Visa/MasterCard domestic lounge program

Cardholder not liable for fraudulent transactions post reporting the loss of card to the bank

You get 40,000 Reward Points as a welcome benefit with the SBI Aurum Credit Card. With this card, you also get Tata CLiQ Luxury vouchers worth Rs. 5,000 on achieving the milestone benefit.

There are no insurance benefits provided along with this card. Earlier subscriptions like Amazon Prime and Discovery Plus were offered along with the card, which has been since discontinued.