Benefites of SBI Credit Card Total Benefits...

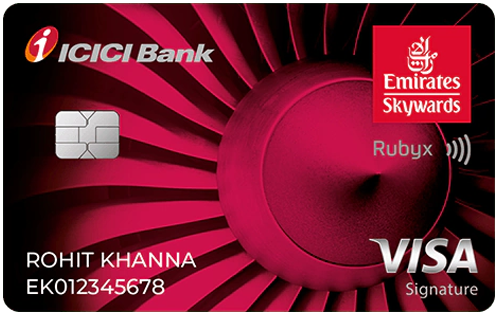

The ICICI Bank has recently launched three co-branded travel credit cards in partnership with the exclusive Emirates Airlines. The Emirates Skywards ICICI Bank Rubyx Credit Card is the most basic card out of the three, the Emirates ICICI Bank Emeralde Card being the most premium one. The Rubyx variant comes with a nominal joining and annual fee of Rs. 1,000 and is targeted at individuals who travel frequently via Emirates airlines and want to have an affordable credit card with maximum travel benefits for them. This card rewards you in the form of Skyward Miles and you can up to 1.5 Miles on every Rs. 100 you spend and redeem these miles against various options available on the Emirates Skywards website. Talking about its other travel benefits, the cardholders get complimentary domestic lounge access every quarter on achieving the quarterly spend milestone. Moreover, you also get complimentary Dreamfolks membership, which can be used to access various domestic as well as international airport lounges worldwide. The Emirates ICICI Bank Rubyx Credit Card has several other benefits. To know all of them, keep reading the article:

New Features

NA

3.4% per month

Rs. 250

Nil

1% fuel surcharge waiver on all fuel transactions at all fuel stations in India.

3.5% on all foreign currency spends

2.5% of the withdrawn amount subject to a minimum of Rs. 500.

25% discount up to Rs. 100 on movie tickets via BookMyShow and exclusive discount offers on dining.

Complimentary domestic lounge access with the dreamfolks membership.

NA

1.5 Skyward Miles on every retail spend of Rs. 100 and 1 Skyward Mile on every spend of Rs. 100 on utility and insurance.

NA

NA

The earned Skyward Miles are automatically credited to the cardholder’s Emirates Skywards account.

1 complimentary domestic lounge access every quarter on spending Rs. 5,000 or more in the previous quarter.

You are not liable for any fraudulent transactions made on a lost/stolen card if the loss is reported to the bank in a timely manner.

No data available

No data available