Benefites of SBI Credit Card Total Benefits...

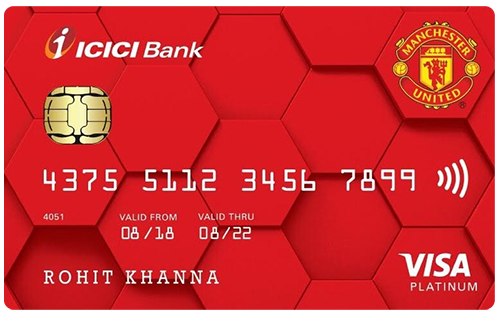

ICICI Bank offers two co-branded credit cards in partnership with Manchester United, which is one of the most popular football clubs in the world- Manchester United Signature Credit Card and Manchester United Platinum Credit Card. The Signature card is more premium of the two variants, while the Platinum Card can be considered a toned-down version of the former. If you’re a Manchester United fanboy, you must possess at least one of these two co-branded cards by ICICI. Manchester United Platinum Credit Card is an entry-level offering by ICICI Bank and comes with a nominal membership fee of just Rs. 499 per annum. Like most other ICICI credit cards, you earn rewards as ICICI Reward Points on the Manchester United Platinum Credit Card. Apart from the Reward Points, you get many Manchester United exclusive benefits with this card that no other credit card currently offers (except obviously, the Signature variant of this card). Read on to learn more about this exclusive Manchester United co-branded credit card by ICICI Bank.

New Features

Renewal fee waived off if Rs. 1.25 lakh were spent in the previous aniversary year

3.67% per month (44.04% per annum)

Rs. 100 (plus applicable taxes)

Rs. 99 (plus applicable taxes) per redemption request

1% fuel surcharge waiver

3.5% on all foreign currency spends

2.5% of the withdrawn amount subject to a minimum charge of Rs. 300

Buy 1 Get 1 offer on movie ticket bookings on BookMyShow and INOX individually (max 2 free tickets on BookMyShow and INOX individually) and 15% savings on dining bills at over 2,500 restaurants across India through Culinary Treats Programme

Complimentary domestic airport lounge access every quarter

N/A

2 Reward Points for every Rs. 100 spent with the card, 3 Reward Points per Rs. 100 spent on Manchester United match days.

N/A

N/A

The earned Reward Points can abe redeemed against a lot of options including cashback and gifts at a rate of 1 Reward Point = Re. 0.25.

1 complimentary doemestic airport lounge access per quarter

Cardholder not liable for any fraudulent transaction made with the card post reporting the loss of card to the bank

No data available

No data available