Benefites of SBI Credit Card Total Benefits...

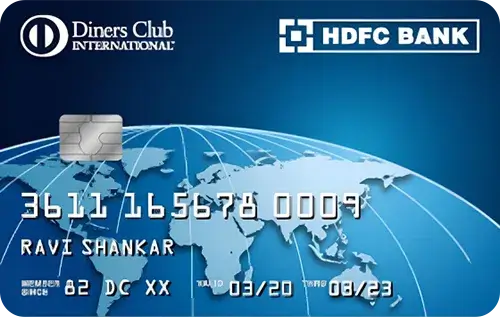

The HDFC Bank Diners Club Rewardz Credit Card is a versatile option for individuals seeking to earn rewards on their everyday spending. Cardholders earn 3 Reward Points for every ₹150 spent on retail purchases and can earn 10X Reward Points with partnered brands, capped at 2,000 points per month. Reward Points can be redeemed for flights, hotel bookings, or products via HDFC's SmartBuy platform, with 1 point equal to ₹0.30. They can also be converted into AirMiles. Upon joining, cardholders receive 1,000 Reward Points as a welcome gift and another 1,000 points as a renewal bonus each year. The card has a joining and renewal fee of ₹1,000, which is waived if annual spending exceeds ₹1 lakh. Additional benefits include a 1% fuel surcharge waiver for transactions between ₹400 and ₹5,000 (up to ₹500 per month).Read below to know more in detail about the HDFC Bank Diners Club Rewardz credit card.

New Features

Earn 3 RPs per Rs. 150 spent on retail. Earn 10X RPs when shopping at partner brands. Get up to Rs. 500 off on fuel surcharge. This card charges a low foreign exchange markup fee of 2%.

No data available