Benefites of SBI Credit Card Total Benefits...

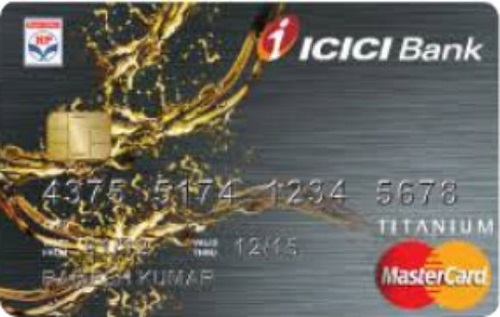

ICICI Bank HPCL Platinum Credit Card offers exclusive cashback benefits on fuel purchases at HPCL petrol pumps. You get 2.5% cashback up to Rs. 100 in a month on fuel purchases if you swipe your credit card on ICICI merchant services POS machines. Moreover, a 1% waiver on fuel surcharge is also applicable on all transactions up to Rs. 4,000. Not only this, you also earn 2 Reward points per Rs. 100 spent on all retail purchases except transactions at fuel stations. The ICICI Bank HPCL Platinum credit card also provides exciting offers on several other categories, such as movies, dining, etc. With a nominal joining fee of Rs. 199, the card is best suited for people who spend on fuel. It can help you save money without any restrictions on your essential purchases. The card also provides a spend-based annual fee surcharge waiver. For detailed information about the ICICI Bank HPCL Platinum Credit card, keep reading:

New Features

The renewal fee can be waived on spending Rs. 50,000 or more in the preceeding year.

3.40% per month (or 40.8% annually)

Nil

Rs. 99 on every redemption request.

1% fuel surcharge waiver at all HPCL pumps for transactions up to Rs. 4,000.

3.50% on all foreign currency spends

2.5% of the transaction amount or Rs. 300 (whichever is higher).

Rs. 100 off on bookings movie tickets via BookMyShow (can be availed max twice in a month), minimum 15% savings on dining through ICICI Bank Culinary Treats Programme.

2 complimentary airport lounge visits outside India and 2 spa sessions at selected airports in India every year, through complimentary Dreamfolks membership

2 complimentary airport lounge visits outside India

2 Reward Points per Rs. 100 you spend with the card

N/A

N/A

1 Reward Point = Rs. 0.25 for redemption against the card’s statement balance or gifts.

N/A

Cardholder shall not be held liable for any unauthorized transaction done on the card after reporting the loss of the card to the bank.

No data available

No data available