Benefites of SBI Credit Card Total Benefits...

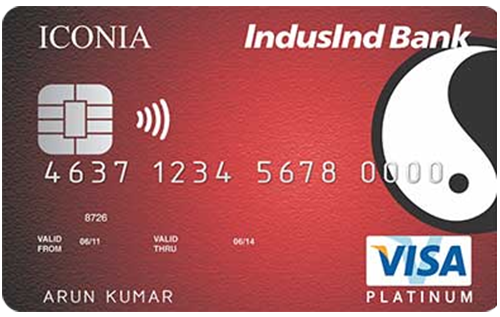

The IndusInd Bank Iconia card is issued in two variants by the bank: IndusInd Bank Iconia Visa credit card and IndusInd Bank Iconia Amex Credit Card. The Visa variant comes with exclusive benefits across several categories, including movies, reward points, gift vouchers, etc. With a joining fee of Rs. 3,499, it provides its customers with exciting welcome benefits, including a number of gift cards and vouchers for Amazon, Flipkart, BATA, Titan, and a lot more brands. Other than that, it provides a ‘Buy 1 get 1 free’ offer on movie tickets on Bookmyshow. With your IndusInd Iconia Visa credit card, you get extra reward points on weekends. It gives you 0.75 Reward points on every Rs. 100 spent on weekdays, and 1 Reward Point on every spend of Rs. 100 on weekends. Not only this, you get complimentary Priority Pass membership that too for yourself and for your add-on cardmember as well. The card has many more other benefits across different categories. If you want to know all about the IndusInd Iconia Visa credit card, its fees & charges, and other features, refer to the information given below:

New Features

Nil

3.83% per month

Nil

Nil

1% fuel surcharge waiver is provided.

3.5% on all foreign currency spends

2.5% of the transacted amount or Rs. 300 (whichever is higher)

Buy 1 get 1 free offer on movie tickets on Bookmyshow.

Complimentary Priority Pass Membership for you and your add-on cardholder.

NA

0.75 Reward Point for every spend of Rs. 100 on weekdays. 1 Reward Point for every spend of Rs. 100 on weekends.

Complimentary golf games and lessons at several leading golf clubs in India.

Insurance coverage for lost baggage, delayed baggage, lost passport, lost ticket, and missed connection is provided.

1RP = Re. 1 for redemption against cash, 1 RP = 1 InterMile / 1 CV Point.

NA

You will not be liable for any unauthorized transactions made on your card if the card is reported lost/stolen to the IndusInd bank within 48 hours.

No data available

No data available