Benefites of SBI Credit Card Total Benefits...

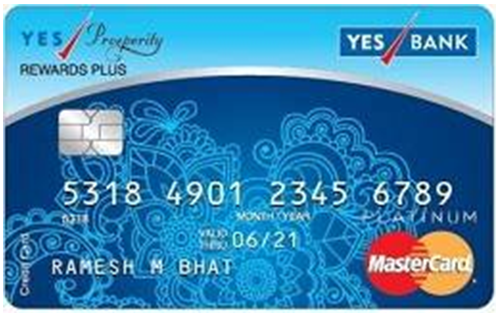

The YES Prosperity Rewards Plus Credit Card, which is a superior version of the YES Prosperity Rewards Credit Card, aims to add a touch of glamour to the lifestyles of its customers with all its benefits and exclusive offers. The card comes with a nominal joining fee of Rs. 399 and gives you several exciting rewards & offers. You get 4 Reward Points on every retail spend of Rs. 200, and for other spendings like tax payments and utilities, you get 2 Reward Points per Rs. 200. The card also gives you an opportunity to get your joining and renewal fee waived off on the basis of your spends. You can get accelerated Reward Points on making purchases through the YES cart. These Reward Points can be redeemed against various categories, including travel, dining, shopping, InterMiles, Club Vistara Points, etc., through the YesRewardz portal. With this card, you can also avail of great offers on travel, dining, shopping, etc., through YesPrivileges. Not only this, but the YES Prosperity Rewards Plus Credit Card has various advantages. To know all of them, keep reading the details given below:

New Features

Waiver of joining and renewal fee on the basis of the amount spent using the credit card.

3.8% per month

Nil

Rs. 100 on every redemption request.

1% fuel surcharge is waived off across all fuel stations in India.

2.75% of the transaction amount

2.5% or Rs. 300 (whichever is higher)

N/A

N/A

N/A

For every retail spend of Rs. 200, cardholders will get 4 Reward Points, and 2 Reward Points for every Rs. 100 spent on tax payments, utilities, postal services, etc.

N/A

In case of the accidental death of the primary cardholder, a credit shield cover is provided.

The reward points can be redeemed against a variety of products and vouchers available on the website.

N/A

Zero liability of the cardholder against any inappropriate transaction that takes place if the card is lost or stolen and the same is reported to the bank within the prescribed time frame.

Low joining fee of Rs. 399. Waiver of joining and renewal fees on reaching milestone benefits.

No international or domestic lounge access is provided with this card. You won’t get any movie benefits along with this card.