Benefites of SBI Credit Card Total Benefits...

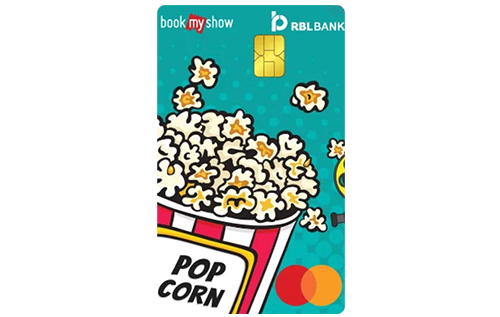

Do you love to go to the movies? If yes, the RBL Bank Popcorn credit card is for you. The card offers exclusive spend-based movie benefits. As a welcome benefit, you get access to 4 free movie tickets (up to Rs. 1000) at Bookmyshow. Not only this, get 2 free movie tickets every month if you spend Rs. 5,000 in a billing month, which is not at all a huge amount to spend in a month. It also provides its customers with exciting weekly cashback offers. On spending Rs. 2,500 in a week, you get assured cashback of Rs. 25 by following a few simple steps for the redemption process. It has several benefits other than those mentioned above. The card carries a nominal annual fee of Rs. 1,000 and will help you a lot to save more. To get complete information about the RBL Bank Popcorn credit card, its benefits and fee, and charges on the card, read the details given below:

New Features

NA

Up to 3.99% per month

Nil

Rs. 99 + GST

1% fuel surcharge or subject to a minimum of Rs. 10 on all transactions between Rs. 500 and Rs. 4,000 (Maximum benefit of Rs. 100 in a month).

Up to 3.5% on all foreign currency spends

2.5% of the amount withdrawn or Rs. 300 (whichever is higher)

An opportunity to earn 2 free movie tickets every month.

NA

NA

2 free movie tickets on spending Rs. 5,000 in a month.

NA

NA

The welcome/monthly offer can be redeemed by booking movie tickets through Bookmyshow and redeem weekly cashback by scanning the QR code at the back of the card.

NA

The cardholder is not liable for any unauthorized transactions done on the card after the report of the same has been provided to the bank.

No data available

No data available