Benefites of SBI Credit Card Total Benefits...

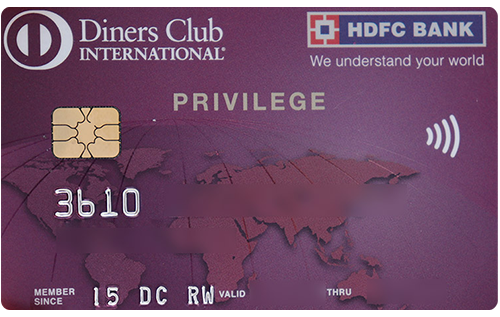

HDFC Bank Diners Club Privilege Credit Card is a premium credit card providing a number of great rewards and benefits to cardholders. To welcome its customers on board, the card offers complimentary memberships to Times Prime and Swiggy One on spending Rs. 75,000 within 90 days of getting the card. With this card, you can earn 4 RPs on every Rs. 150 you spend and upto 10x reward points on SmartBuy spends. Also, you can earn earn accelerated 5x RPs on Swiggy and Zomato spends, and BOGO offer on BookMyShow tickets for weekend shows. These reward points can later be redeemed against an array of categories, including flight/hotel bookings, products/vouchers, and cash credit at a very good rate. Talking about its travel benefits, you get complimentary access to over 1,000 lounges all over the world. Moreover, there are several more benefits of the card, including spend based annual fee waiver, fuel surcharge waiver, insurance benefits, etc. Read below to know more in detail about the HDFC Bank Diners Club Privilege credit card.

New Features

Get 5x (20) reward points per Rs. 150 spent on Swiggy and Zomato

Nil

4 RPs per Rs. 150 spent and 5x RPs on Zomato and Swiggy spends Frequent travellers can benefit from 8 complimentary domestic and international lounge access 8 complimentary golf rounds at top courses in India and abroad