Benefites of SBI Credit Card Total Benefits...

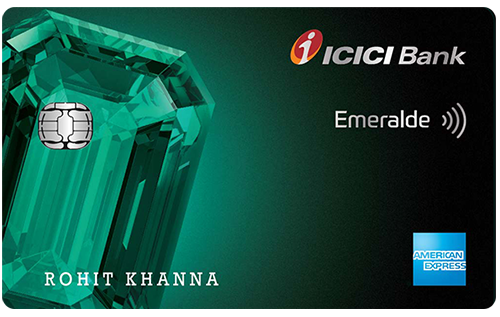

ICICI Bank Emeralde Credit Card is among the most premium offering by the bank and can be considered a tough competitor to the HDFC’s Infinia credit card. With this card, ICICI targets HNIs (High Net-Worth Individuals) who frequently go on business trips and don’t want to compromise with their lifestyle. ICICI Bank Emeralde Credit Card offers exclusive benefits like a 24×7 concierge service (that provides assistance regarding hotel/restaurant reservations, flight bookings, car rentals), unlimited complimentary airport lounge access to domestic as well as international terminals, personal air accident insurance cover of Rs. 3 crore, etc. Keeping all the traveling requirements of its premium customers in mind, ICICI charges a nominal foreign currency markup fee of 1.5% on transactions made in a different currency and a zero cash advance fee on cash withdrawals from ATMs. ICICI Bank used to offer the Emeralde Credit Card in two variants- MasterCard and American Express variants. But since both these payment networks are currently not allowed to onboard new customers, the bank has recently also launched the card on the Visa platform. One unique feature of ICICI Bank Emeralde Credit Card is that it allows you to choose between two membership plans- the monthly plan, where the cardholders need to pay a monthly fee of Rs. 1,000 and the annual plan with an annual membership fee of Rs. 12,000.

New Features

A discount of up to Rs. 750 on BookMyShow second movie/event ticket onwards (max 4 tickets per month), no cancellation charge on movie ticket cancellation (max benefit of Rs. 12,000 per year), a minimum discount of 15% at partnered restaurants under the ICICI Culinary Treats program.

Nil

No data available