Benefites of SBI Credit Card Total Benefits...

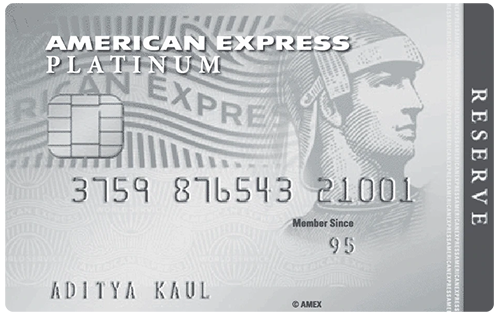

The Platinum Reserve credit card is the second most premium credit card that American Express offers, only next to the Platinum card, which is a Charge Card (Charge cards have a variable credit limit). Looking at the benefits that it offers, from Taj Epicure membership to the Hotel Collection program, one might consider it a travel credit card. However, it offers many other benefits, including exclusive dining benefits, complimentary golf, and movie vouchers. Apart from all these benefits, AmEx cards are known for their brand value. Many prefer AmEx cards over Visa and MasterCard just for that reason. Here, we’ve covered in detail all the features and benefits this card offers. Read on to find out whether it fits your needs.

New Features

N/A

3.5% per month

4 add-on cards free, Rs. 1,500 / card chargable for each additional card.

Nil

Waived at HPCL fuel stations for transactions up to Rs. 5,000, 1% surcharge on BPCL and IOCL stations and 2.5% surcharge at all other fuel stations.

3.5% of the transaction amount

3.5% of the advanced amount, subject to a minimum amount of Rs. 250.

BookMyShow vouchers worth Rs. 500 on the monthly expenditure of Rs. 25,000, complimentary Taj Epicure membership, complimentary membership of EazyDiner Prime.

Complimentary domestic lounge access annually, Priority Pass membership, Complimentary Taj Epicure Membership

Complimentary Priority Pass membership. USD 32 / person / visit chargable.

1 Membership Reward Point for every Rs. 50 spent with the card except for spends on fuel, utilities, insurance, cash transactions, and EMI conversion at Point of Sale.

2 complimentary rounds of golf per month at 32 premium golf destinations in India with a 100% waiver on the green fee.

Air accident cover worth Rs. 1 crore, purchase protection against loss, damage, or burglary of any item purchased using the card

Membership Rewards Points redeemable for online shopping vouchers, INSTA rewards for offline purchases, transfer to various flight and hotels loyalty programs and for making credit card bill payments under the Cash + Points scheme.

12 complimentary domestic lounge visits (limited to 3 per quarter)

No liability on cardholder for fraudulent use provided the loss of card is reported within 3 days. Liability limited to Rs. 1000 if loss of card reported after 3 days.

For frequent flyers, this card offers 12 domestic lounge visits and a Priority Pass membership. You would get 11,000 Membership Reward Points on the realisation of card joining fees.

Although the joining fee is Rs. 5,000, the annual fees chargeable from the second year is Rs. 10,000. There is no complimentary international lounge access (with Priority Pass Membership, you can access them at discounted rates).