Benefites of SBI Credit Card Total Benefits...

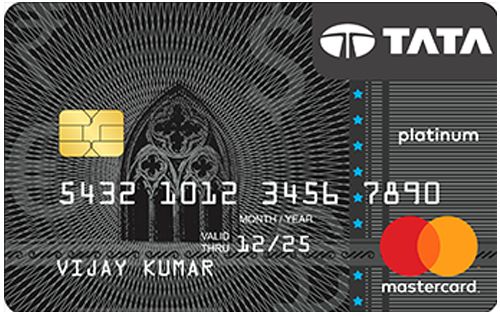

SBI TATA Platinum Card is a co-branded car launched by SBI Card in collaboration with TATA Capital. On this card, you get upto 3 reward points on every Rs 100 spent on Dining, Departmental & Grocery shopping, and International spends. You get 1 empower point on every Rs 100 spent on other retail outlets and 1 empower point on every Rs 100 spent in other retail stores. You get upto 8 complimentary domestic lounges every year at select airports. Furthermore, you can enjoy an e-Gift voucher worth Rs 3,000 on annual spending of Rs 4 lakh and 5 lakhs. What do you think about this card? Do let us know in the comments.

New Features

NA

3.5% per month (42% per annum)

Nil

Rs 99 per redemption request

1% surcharge waiver on fuel transactions at all fuel stations across India

3.5% on the conversion amount

2.5% on the transaction amount subject to a minimum charge of Rs 500

NA

Complimentary lounge access in India at select airports

NA

You can upto 3 Empower points on Dining, Departmental & Grocery shopping, and International spends. You get 1 Empower point on every Rs 100 spent on other retail categories. You earn 1 Empower point on every Rs 100 spent on retail stores

NA

NA

1 Empower Point = Rs. 1 can be redeemed against the Tata Loyalty program- The Empower Program or you can simply redeem your reward points at TATA merchant outlets.

8 complimentary lounge access in India with Mastercard at select airports

NA

No data available

No data available