Benefites of SBI Credit Card Total Benefits...

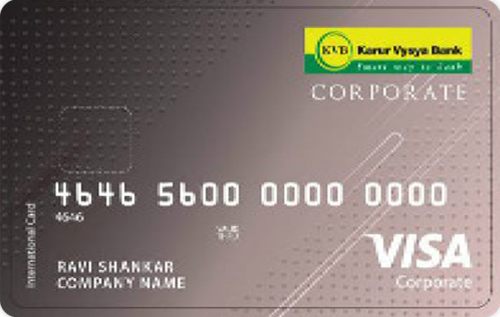

KVB Corporate credit card is a Visa card offered by the Karur Vysya Bank. You get 2 reward points on every Rs 100 spent using your credit card. In addition to this, you also get 2 complimentary lounge access in India using the KVB corporate credit card. There are various other benefits and rewards associated with the KVB corporate credit card. Read below to know more about this credit card.

New Features

NA

2.95% per month ( 35.40 p.a.)

Nil

Nil

2% fuel surcharge waiver on fuel transactions per month 300 for transactions of Rs 400 to Rs 4000.

NA

2% on the withdrawal amount or Rs 100 whichever is higher

NA

NA

NA

2 Reward Points on every Rs 100 spent using this KVB credit card.

NA

NA

You can redeem your reward points by calling the customer care number at 1800 419 6500/022-404 260 31. The customers can log in to your internet banking or mobile banking

2 complimentary domestic lounge access

NA

No data available

No data available