Benefites of SBI Credit Card Total Benefits...

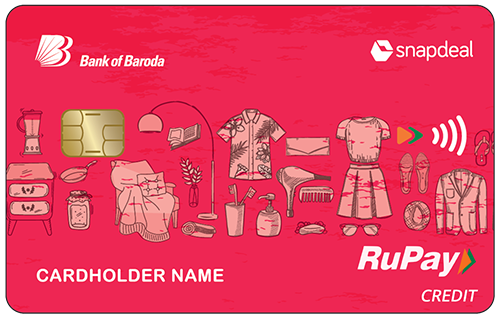

The Bank of Baroda has recently launched a co-branded shopping card in partnership with the online shopping site, Snapdeal. This card is named Snapdeal Bank of Baroda Credit Card, which is majorly targeted at providing its customers with the best shopping privileges. The card comes with a joining and annual membership fee of Rs. 249 only, making it super affordable for everyone. The BoB Snapdeal Credit Card is a great option for those who purchase very often on Snapdeal as it offers a great reward rate of 5% on Snapdeal spends. The card also offers a really good reward rate across other categories as well, including groceries, online spends, and several more. For further information about the Snapdeal Bank of Baroda Credit Card, its features, and fees & benefits, keep reading the article:

New Features

NA

3.25% per month

Nil

Nil

1% fuel surcharge waiver on all fuel purchases between Rs. 400 and Rs. 5,000.

3.50% of the total transaction amount

2.5% of the cash amount or Rs. 300 (whichever is higher)

NA

NA

NA

5% cashback on Snapdeal, 10 RPs on every Rs. 100 spent on groceries, online spends & departmental stores, and 4 RPs on every Rs. 100 spent elsewhere.

NA

NA

The earned Reward Points are automatically credited to your credit card account at a rate of 1 Reward Point = Re. 0.25.

NA

The cardholders get a zero liability protection against a lost/stolen card if reported to the issuer within 48 hours.

No data available

No data available