Benefites of SBI Credit Card Total Benefits...

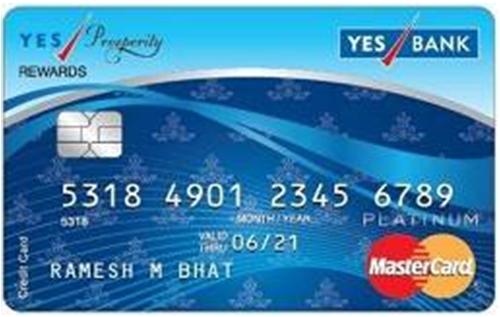

YES BANK Prosperity Rewards credit card is a card that rewards you on every penny spent. This card provides a great value of money by charging you with a minimal annual fee while you earn up to 2 reward points on every Rs 200/- spent except select categories and 1 reward point on every Rs 200 spent on select categories. These reward points can be redeemed at the YesRewardz portal product catalog and can also be redeemed against Air Miles. Read below to know about this credit card.

New Features

4 Reward Points per Rs. 200 spent on dining

2 Reward Points on every Rs 200 spent on all categories other than select categories 1 Reward Point for every Rs. 200 on Select categories 4 Reward Points for every Rs. 200 spent on dining and travel

Nil

No data available