Benefites of SBI Credit Card Total Benefits...

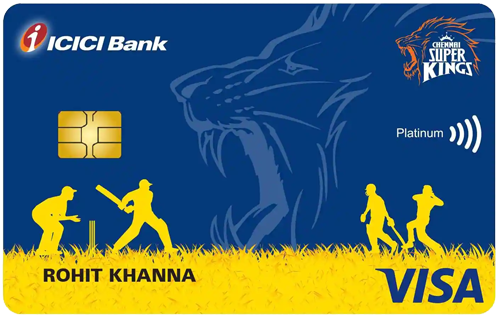

The Chennai Super Kings ICICI Bank Credit Card has recently been launched by the ICICI Bank in partnership with the IPL team, CSK. It is targeted at individuals who are big fans of the team and have a dream of meeting the team players or getting their autographs. With this credit card, you may get an opportunity to get the autograph of key CSK players and you may even meet them. Other than offering exciting privileges targeted at CSK fans, the card also offers a decent reward rate on all other retail spends and accelerated rewards on CSK match days. The earned reward points are redeemable against a variety of options including CSK merchandise. The CSK ICICI Bank Credit Card comes with an annual fee of Rs. 500 and can be considered a great choice for sports enthusiasts. The ICICI Bank already issues sports two credit cards in partnership with Manchester United, named Manchester United ICICI Bank Platinum & Signature Credit Cards, and now this new launch has been added to the card issuer’s portfolio. To know more about the features and all the fees & charges of the CSK ICICI Bank Credit Card, keep reading the article:

New Features

The annual fee is waived off on spending Rs. 1.5 lakhs in the previous year.

3.4% per month

Nil

Nil

1% fuel surcharge waiver on all fuel transactions worth up to Rs. 4,000 at all HPCL pumps.

3.5% on all foreign currency spends.

2.5% of the withdrawn amount subject to a minimum of Rs. 500.

NA

Complimentary domestic airport lounge access.

NA

2 Reward Points on every retail spend of Rs. 100, 10 Reward Points on every Rs. 100 during CSK match days and 1 Reward Point on all Insurance and utility spends.

NA

NA

The earned Reward Points can be redeemed against CSK merchandise. 1 Reward Point = Re. 0.25.

1 complimentary domestic lounge access every quarter on spending Rs. 5,000 in the previous quarter.

You get a zero liability protection against a lost/stolen card if the card is reported lost to the bank in a timely manner.

No data available

No data available